Refund Pre-Application is a form, which need to be submitted by the taxpayers to provide certain information related to nature of business, Aadhaar Number, Income Tax details, export data, expenditure and investment etc. To submit Refund Pre-Application Form, perform following steps:

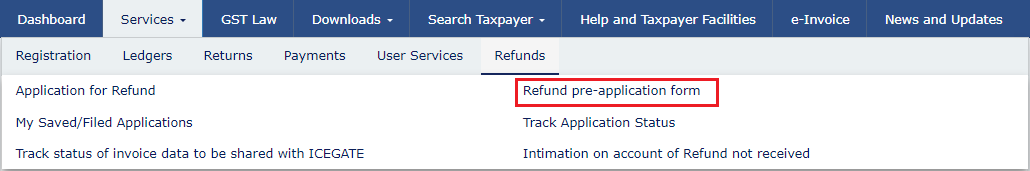

1. Login to the GST Portal. Navigate to Services > Refunds > Refund pre-application Form option.

Note:

Taxpayer is not required to sign the Refund Pre-Application form.

Once the form is submitted, you cannot edit or re-submit the form.

2. Refund pre-application Form page is displayed.

3. Select the Nature of Business from the options given.

4. Select the Date of Issue of IEC (Only for Exporters).

5. Enter the Aadhaar Number of Primary Authorized Signatory.

6. Enter the Value of Exports made in the Financial Year 2019-2020 (till date) (Only for Exporter), Income tax paid in Financial Year 2018-2019, Advance tax paid in Financial Year 2019-2020 (till date) and Capital Expenditure and investment made in Financial Year 2018-2019.

7. Select the declaration checkbox and click SUBMIT.

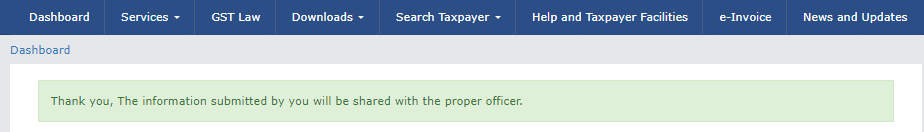

8. A confirmation message about the submission of the form is displayed.

Note: On submitting the refund pre-application form, an acknowledgement message will be shown to you on the screen. No separate e-mail or SMS will be sent to you for the same.