To file for cancellation of GST registration, please perform the following steps:

1. Visit the URL: https://www.gst.gov.in.

2. Login to the GST Portal with your user-ID and password.

3. Navigate to the Services > Registration > Application for Cancellation of Registration option.

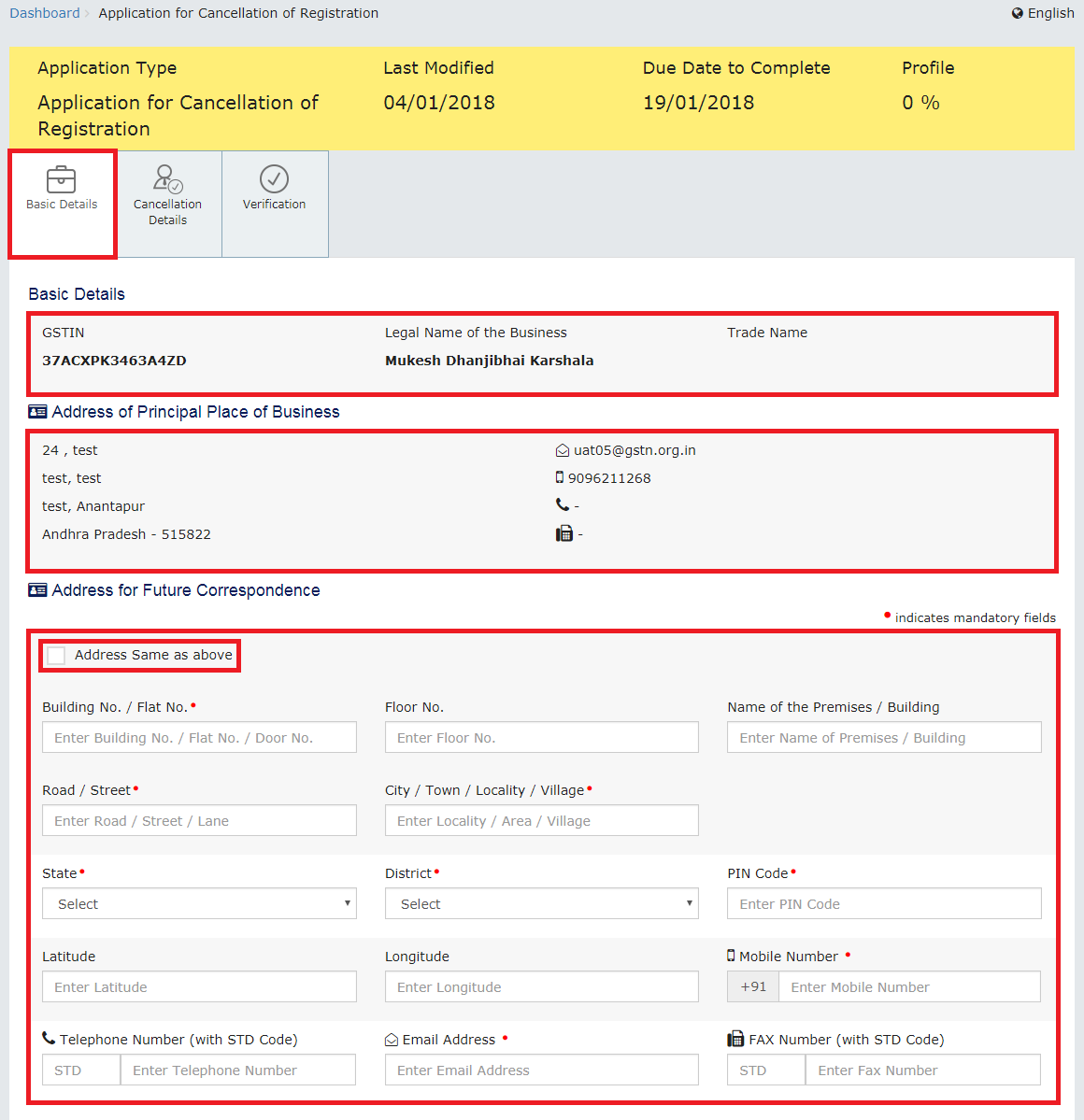

4. The form - Application for Cancellation of Registration contains three tabs. Ensure that the Basic Details tab is selected by default.

Note: The first tab contains pre-filled information in sections of Basic Details and Address of Principal Place of Business.

5. Either fill your Address for Future Correspondence manually, or check the option of Address same as above to copy the same address as in the Address of Principal Place of Business field.

6. Click the SAVE & CONTINUE button.

Notes:

The tab Basic Details will change to blue color and a tick mark will appear on it indicating that all the mandatory fields under this tab have been duly filled-in.

The next tab Cancellation Details will get active, requiring you to make suitable selections and provide relevant information in corresponding fields.

7. Select a suitable reason from the Reason for Cancellation drop-down list.

Notes: The following five reasons are available for selection:

a) Change in constitution of business leading to change in PAN

b) Ceased to be liable to pay tax

c) Discontinuance of business / Closure of business

e) Transfer of business on account of amalgamation, merger, demerger, sale, leased or otherwise

Change in constitution of business leading to change in PAN:

a) Enter the date from which registration is to be cancelled.

b) Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

Ceased to be liable to pay tax:

a) Enter the date from which registration is to be cancelled.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

Discontinuance of business / Closure of business:

a) Enter the date from which registration is to be cancelled.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

a) Specify the reason for cancellation.

b) Enter the value of stock and the corresponding tax liability on the stock.

c) Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

d) On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise:

a) Enter the date from which registration is to be cancelled.

b) Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

8. Click the SAVE & CONTINUE button.

Notes:

This will mark the second tab also as complete.

The next tab, Verification will get activated.

9. Check the Verification statement box to declare that the information given in this form is true and correct, and that nothing has been concealed therefrom.

10. Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

11. Enter the Place of making this declaration.

Note: Notice that the system auto-populates the authorised signatory’s designation or status.

12. Sign the form by using either your Digital Signature Certificate (DSC), or the EVC option.

Notes:

For the purpose of simplicity, this user manual has followed the EVC path.

If using a DSC, you will be required to select your registered DSC from the emSigner pop-up window and then proceed from there accordingly.

13. Enter the OTP.

Notes:

On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

A confirmation message will also be sent by GST Portal on your registered mobile phone number and e-mail-ID.

After this stage, the concerned Tax Official will review your application and take a decision accordingly.

14. To view the ARN, navigate to the Services > Registration > Track Application Status option.

15. Select Submission Period radio button.

16. Enter the From and To dates between which you filed for cancellation of registration.

17. Click the SEARCH button.

Note: The search result will display the ARN corresponding to your filed application.

Taxpayer can withdraw his/her request for cancellation of registration till the time the authorized tax officer has not taken any action on the application. To withdraw the request for cancellation of registration, perform the following steps:

1. Login to the GST portal with valid credentials. Click the Services > User Services > View My Submissions option to view your submissions. Click the withdraw button.

Note: The withdraw option will only be available till the time the authorized tax officer has not taken any action on the application i.e. the status of the Application is in “Pending for Processing” status. In case, tax officer has initiated some action on the application, there would be no withdraw button available for the taxpayer to withdraw his/her application.

2. Click the CONFIRM button.

3. A confirmation message will be displayed on the screen. Click the OK button.

4. Updated list of My Submissions is displayed. Withdrawl hyperlink will not be visible now.

Note: An alert will be sent to the authorized officer mentioning that the Application with XXXXXXXXXX ARN number has been withdrawn by the Applicant.