Migrated taxpayers need to login first time to the GST Portal with Provisional ID and password. New taxpayers need to login first time to the GST Portal with GSTIN and password.

As a new taxpayer, to login first time to the GST Portal with GSTIN and password, you need to perform the following steps:

1. Access the URL https://www.gst.gov.in/. The GST Home page is displayed.

2. Click the Login link given in top right-hand corner of the GST Home page.

3. The Login page is displayed. Click the here link in the instruction at the bottom of the page that says “First time login: If you are logging in for the first time, click here to login”.

4. The New User Login Page is displayed. In the Provisional ID / GSTIN/ UIN field, type the Provisional ID/ GSTIN/ UIN received on your e-mail address.

5. In the Password field, type the password received on your e-mail address.

6. In the Type the characters you see in the image below field, type the captcha text displayed in the box.

7. Click the LOGIN button.

8. The New Credentials page is displayed. In the New Username field, enter the username that you want to create to login to the GST Portal.

9. In the New Password field, enter a password of your choice that you will be using from next time onwards

10. In the Re-Confirm Password field, reenter the new password.

11. Click the SUBMIT button.

12. A confirmation message is displayed that Username and Password have been successfully created. You can now login to the GST Portal using these credentials.

13. In the Username field, type the username that you created.

14. In the Password field, type the password.

15. Click the LOGIN button.

16. When you login for the first time on the GST Portal, you will be prompted to file a non-core amendment application to enter Bank Accounts details. Click FILE AMENDMENT button.

Note 1: Adding bank details is optional for TDS and TCS taxpayers. Click SKIP button to continue to dashboard.

Note 2: For all other taxpayers, if even after 45 days, they have not added Bank Account details through Non-Core Amendment, they can only navigate to add Bank Account through Non-Core Amendment. These taxpayers cannot navigate to any other functionality till they add Bank account details and File Non-Core Amendment, as it is only applicable for TDS and TCS taxpayers. These Taxpayers can only log out form the GST Portal.

17. The application form for editing is displayed and non-core fields is available in editable form. Edit the details in the Bank Accounts tab by clicking ADD NEW button.

Click here to know more about amendment of non-core fields.

To retrieve your username, you need to perform the following steps:

1. Access the URL https://www.gst.gov.in/. The GST Home page is displayed.

2. Click the Login link given in top right-hand corner of the GST Home page.

3. The Login page is displayed. Click the Forgot Username link, given below the LOGIN button.

4. The User Credentials page is displayed. In the Provisional ID / GSTIN / UIN field, type the Provisional ID or GSTIN that you received in the e-mail.

5. In the Type the characters you see in the image below field, type the captcha text shown on the screen.

6. Click the GENERATE OTP button. The One Time Password (OTP) will be sent to your registered e-mail address and mobile number.

7. The OTP Verification page is displayed. In the Enter OTP field, enter the OTP that was sent to your registered e-mail address and mobile phone number.

8. Click the SUBMIT button.

Note:

In case your OTP is expired and you want to receive the OTP again on your e-mail address and mobile phone number, click the RESEND OTP link.

The message “Username has been emailed to your registered Email address. Kindly check your email” is displayed. Check your registered e-mail to retrieve the username.

To retrieve your password, you need to perform the following steps:

1. Access the URL https://www.gst.gov.in/. The GST Home page is displayed.

2. Click the Login link given in top right-hand corner of the GST Home page.

3. The Login page is displayed. Click the Forgot Password link.

4. The User Credentials page is displayed. In the Username field, type the username that you created while logging in first time to the GST Portal.

5. In the Type the characters you see in the image below field, type the captcha text shown on the screen.

6. Click the GENERATE OTP button. The One Time Password (OTP) will be sent to your registered e-mail address and mobile number.

7. The OTP Verification page is displayed. In the Enter OTP field, enter the OTP that was sent to your registered e-mail address and mobile phone number.

8. Click the CONTINUE button.

Note: In case your OTP is expired and you want to receive the OTP again on your e-mail address and mobile phone number, click the RESEND OTP button.

9. The New Credentials page is displayed. In the New Password field, enter a password of your choice that you will be using from next time onwards.

10. In the Re-confirm Password field, reenter the password.

Note: Password should be of 8 to 15 characters which should comprise of at least one number, one special character, one upper case and one lower case letter.

11. Click the SUBMIT button.

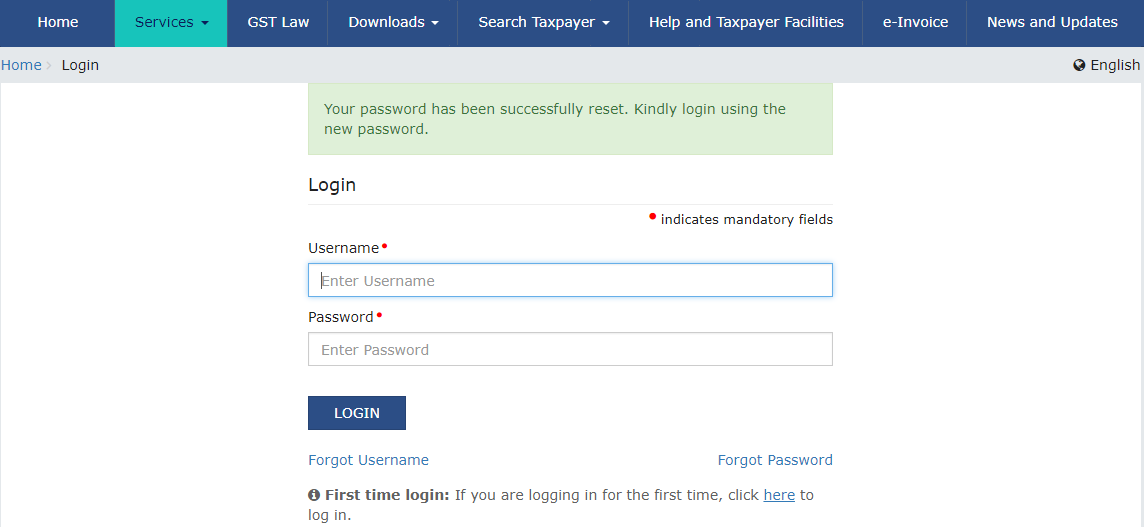

The message "Your password has been successfully reset. Kindly login using the new password.” is displayed. You can login to the GST Portal using the new password from next time.

To change your password, you need to perform the following steps:

Note: You need to change the password mandatorily after 120 days.

1. Access the URL https://www.gst.gov.in/. The GST Home page is displayed.

2. Login to the GST Portal using valid credentials.

3. The Dashboard is displayed. Click the Change Password link, on the top right-hand corner of the page.

4. The Change Password page is displayed. In the Old Password field, enter the old password that you used to login.

5. In the New Password field, enter a password of your choice that you will be using from next time onwards.

Note:

Password should be of 8 to 15 characters (where the minimum length is 8 characters and maximum length is 15 characters) which should comprise of at least one number, special character and letters (at least one upper and one lower case).

New Password can not be same as previous 5 passwords.

6. In the Re-confirm Password field, reenter the password.

7. Click the CHANGE PASSWORD button.

The message “Password has been successfully changed” is displayed. You can login to the GST Portal using the new password from next time.

After completing registration process, to login to GST portal perform the following steps:

1. Navigate to GST login portal, enter your Provisional ID/GSTIN/UIN and Password you entered during account creation.

2. Enter the captcha in Type the characters you see in the image below field.

3. Click the LOGIN button.

4. Pass through the second round of authentication by entering the OTP sent to your registered mobile number via text message and registered email id and enter the OTP in OTP field.

5. Click the SUBMIT button.

Note:

1. You don’t have to enter OTP every time you login via a trusted browser/device that you have previously authenticated from.

2. You will be asked to Enter OTP in the following case:

• When you log in for the first time using your credentials.

• When you try to login for more than 5 times within a minute.

• When you login from a new device that you have previously not authenticated from.

• Whenever you try to login for more than 10 devices in an hour.

• When you try to login, checks if MFP is not matched with the corresponding MFP of Device ID.

.• If anyone is trying to login from a distant location within a short duration.

3. You will not be able to log in from a country other than India. If you log in from some other country the system will blacklist you and following message will be displayed on the screen.

4. If you log in from an untrusted IP then you will not be able to log in and get blocked, following message will be displayed on the screen.