Form GSTR-4A is an auto-drafted and view only form for composition taxpayer, created on basis of data from the saved/submitted/filed Form GSTR-1/A & 5 of their suppliers, where composition taxpayer is the recipient. The composition taxpayer cannot take any action in Form GSTR-4A and this form is only for view.

To view the auto-drafted details in Form GSTR-4A, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed. Login to the GST Portal with valid credentials. Click the Services > Returns > Returns Dashboard option.

Alternatively, you can also click the Returns Dashboard link on the Dashboard.

2. The File Returns page is displayed. Select the Financial Year & Return Filing Period for which you want to view Form GSTR-4A from the drop-down list. Click the SEARCH button. GSTR4A tile is displayed.

3. Download GSTR-4A: To download Form GSTR-4A details in excel

4. View GSTR-4A: To view Form GSTR-4A details directly on GST Portal

3. Download GSTR-4A: You can use DOWNLOAD GSTR-4A option to download all Form GSTR-4A details, in an excel format, for any range of quarters, in the selected financial year.

3.1. In the GSTR4A tile, click the DOWNLOAD button.

3.2. Select the From and To Quarter from the drop-down list and click the GENERATE EXCEL FILE TO DOWNLOAD button to download GSTR-4A details in an excel format.

3.3. Success message is displayed. Once the file is generated, the link will appear to download the same. Click on the link to download the file.

3.4. A zip file is downloaded.

3.5. Unzip the file and click the downloaded excel file.

3.6. Excel file with Form GSTR-4A details are displayed.

• B2B: To view all the inward supplies received from registered suppliers

• B2BA: To view invoices which are amended by the supplier in their returns of Form GSTR-1/1A/5 respectively

• CDNR: To view Credit/Debit notes added by the supplier in their respective returns (Form GSTR-1/1A/5)

• CDNRA: To view amendments of Credit/Debit notes done by the supplier in their respective returns (Form GSTR-1/1A/5)

4.1. In the Form GSTR-4A tile, click the VIEW button to view the details directly on GST Portal.

4.2. The Form GSTR-4A – AUTO DRAFTED DETAILS page is displayed.

Click the tile names to know more details:

5. 3A,3B - B2B Invoices: To view all the inward supplies received from registered suppliers

6. 4 - Amendments to B2B Invoices: To view invoices which are amended by the supplier in their returns of GSTR-1/5 respectively

7. 4 - Credit/Debit Notes To view Credit/Debit notes added by the supplier in their respective returns (GSTR-1/5)

8. 4 - Amendments to Credit/Debit Notes: To view amendments of Credit/Debit notes done by the supplier in their respective returns (GSTR-1/5)

This section displays all the inward supplies received from registered suppliers. The B2B section of PART A of GSTR-4A is auto-populated on uploading or saving of invoices by the suppliers in their respective returns of GSTR-1/1A and GSTR-5.

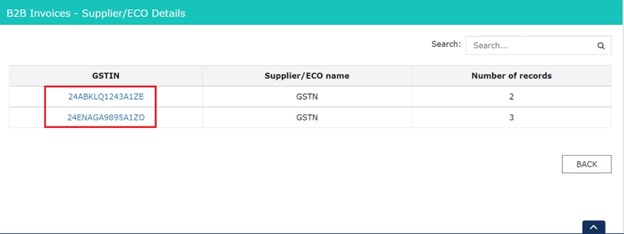

5.1. Click the 3A,3B - B2B Invoices tile. The B2B Invoices - Supplier Details page is displayed.

5.2. Click the GSTIN hyperlink to view the invoices uploaded by the supplier.

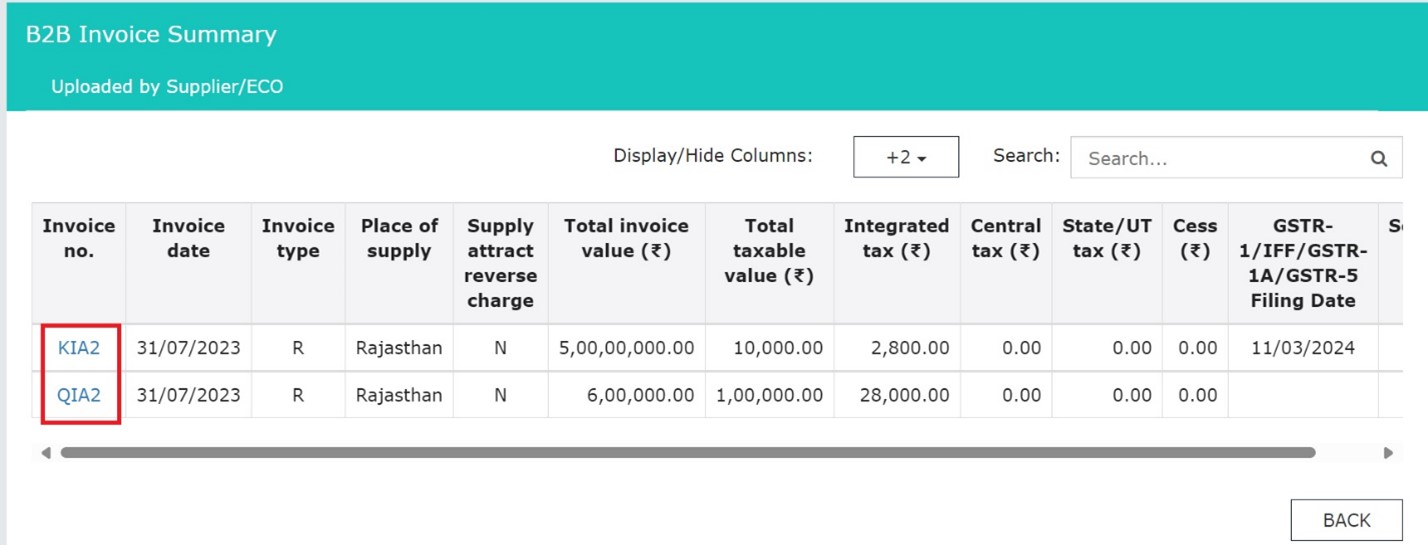

5.3. Click the Invoice No. hyperlink to view the invoice details.

5.4. The item details are displayed.

Click here to go back to main menu

6. 4 - Amendments to B2B Invoices

This section covers the invoices which are amended by the supplier in their returns of GSTR-1/1A/5 respectively.

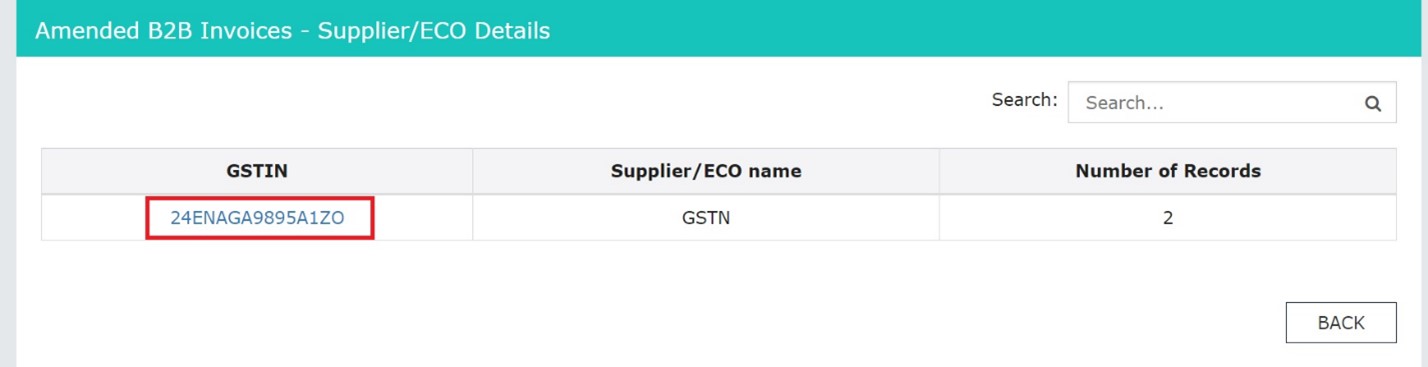

6.1. Click the 4 - Amendments to B2B Invoices tile. The Amend B2B Invoices - Supplier Details page is displayed.

6.2. Click the GSTIN hyperlink to view the amended invoices uploaded by the supplier.

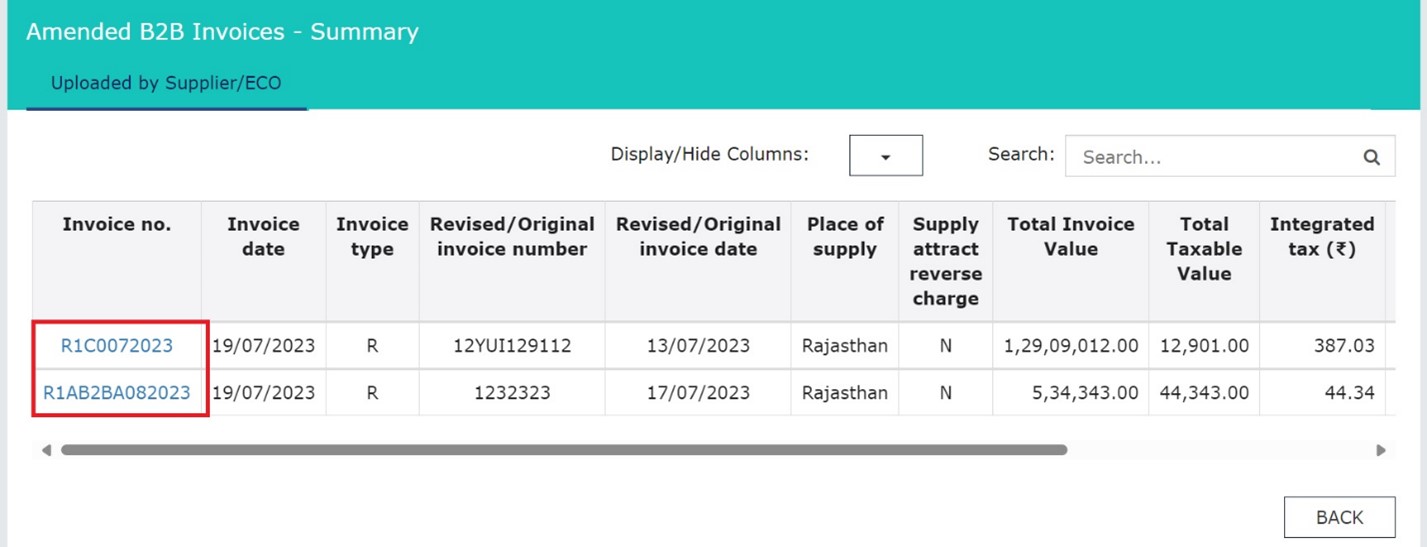

6.3. Click the Invoice No. hyperlink to view the invoice details.

6.4. The item details are displayed.

Click here to go back to main menu

This section covers the Credit/Debit notes added by the supplier in their respective returns (Form GSTR-1/1A/5).

7.1. Click the 4 - Credit/Debit Notes tile. The Credit/Debit Notes – Supplier Details page is displayed.

7.2. Click the GSTIN hyperlink to view the credit/debit notes uploaded by the supplier.

7.3. Click the Credit/ Debit Note No hyperlink to view the credit/debit note details.

Scenario 1: You will see below screenshot, in case you have filed your returns/statements after delinking of credit and debit notes on the GST Portal.

Scenario 2: You will see below screenshot, in case you have filed your returns/statements before delinking of credit and debit notes on the GST Portal.

Scenario 3: You will see the below screenshot, in case you have saved your returns/statements before delinking of credit and debit notes and filed your statements/returns after delinking of credit and debit notes on the GST Portal.

7.4. The item details are displayed.

Click here to go back to main menu

8. 4 - Amendments to Credit/Debit Notes

This section covers the amendments of Debit / credit notes done by the supplier in their respective returns (GSTR-1/1A/5).

8.1. Click the 4 - Amendments to Credit/Debit Notes tile. The Amend Credit/Debit Notes - Supplier Details page is displayed.

8.2. Click the GSTIN hyperlink to view the amended credit/debit notes uploaded by the supplier.

8.3. Click the Credit/ Debit Note No hyperlink to view the invoice details.

Scenario 1: You will see below screenshot, in case you have filed your returns/statements after delinking of credit and debit notes on the GST Portal.

Scenario 2: You will see below screenshot, in case you have filed your returns/statements before delinking of credit and debit notes on the GST Portal.

Scenario 3: You will see the below screenshot, in case you have saved your returns/statements before delinking of credit and debit notes and filed your statements/returns after delinking of credit and debit notes on the GST Portal.

8.4. The item details are displayed.

Click here to go back to main menu