To take action against the notices/reports issued by the Tax Official during the Audit process, perform the following steps:

Click each hyperlink above to know more.

Taxpayers can use this functionality to view all the Case Details which will further display all Notices, Replies, Payment Details, Acknowledgement, Reports and Requests issued against a particular case by the Tax Official during Audit Process. To view all these communications issued, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed. Login to the portal with valid credentials. Dashboard is displayed. Click Dashboard > Services > User Services > View Additional Notices/Orders option.

2. Additional Notices and Orders page is displayed. Click the View hyperlink under the Action column to go to the Case Details screen of the issued notices/reports.

Note: All issued notices/reports are displayed on the screen. You can search for the notices/reports you want to view using the navigation buttons provided at the bottom of the table.

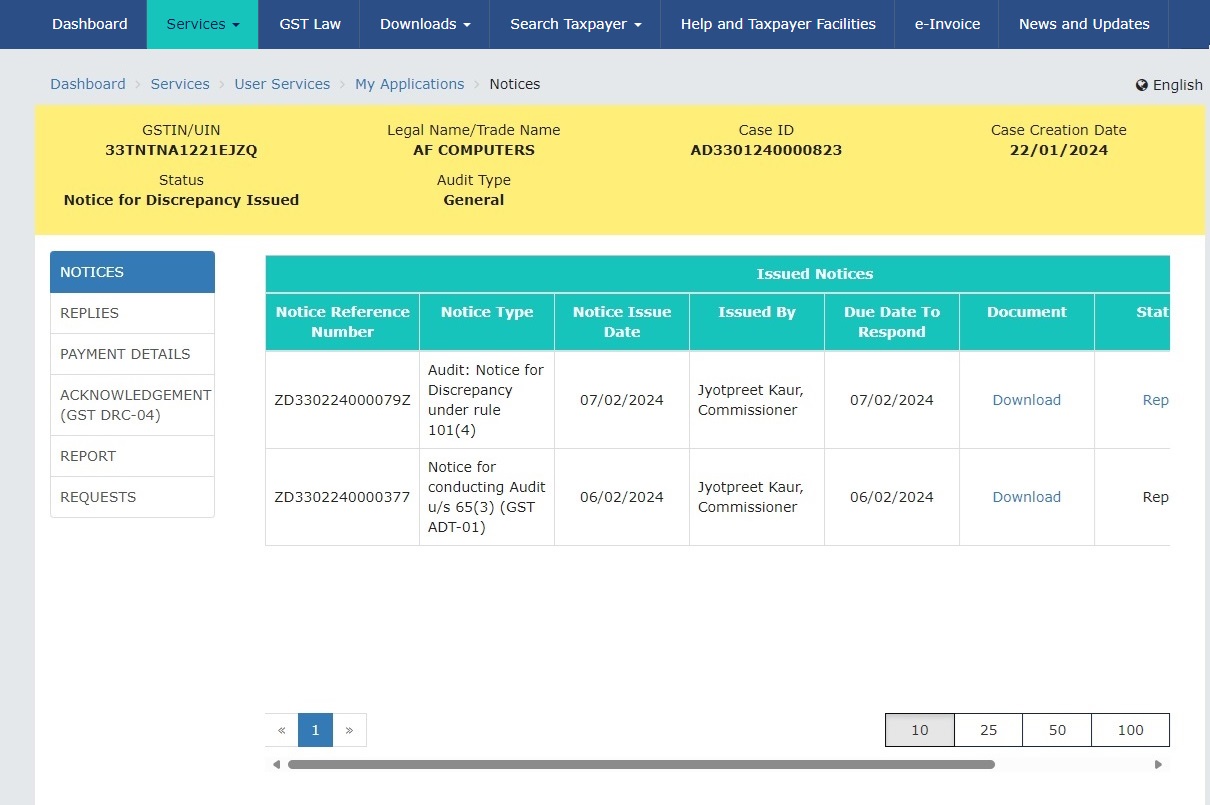

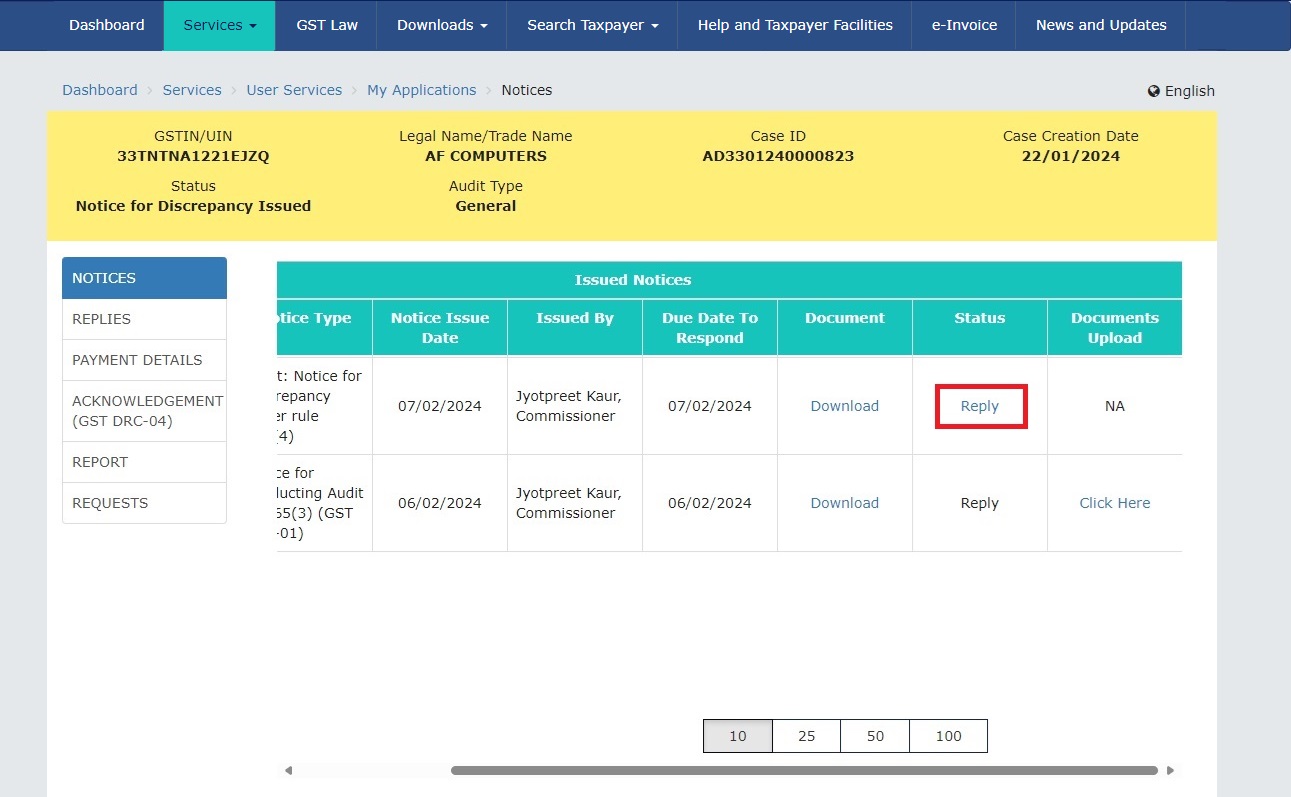

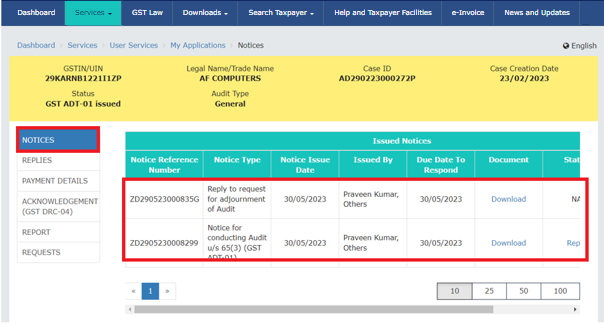

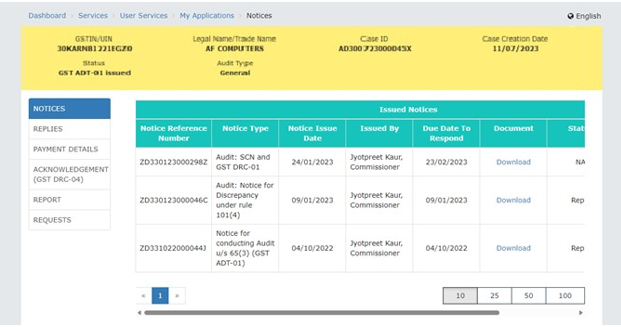

3. Case Details page is displayed. The NOTICES tab is selected by default. Click the NOTICES, REPLIES, PAYMENT DETAILS, ACKNOWLEDGEMENT (GST DRC -04), REPORT and REQUESTS tabs provided on the left-hand side of the page to view more details of the case in each tab.

Taxpayer can use this functionality to view the notices issued against them by the Tax Official, in order to get additional information, documents etc. to proceed further during the Audit process. These Notices are available in the NOTICES tab of Case Details page. To view different types of notices issued against you by the Tax Official for a particular case, perform the following steps:

1. On the Case Detail page of that particular Case ID, select the NOTICES tab. This tab displays all the notices (Notice for Conducting Audit/Reminders/Adjournment etc.) issued to taxpayer. Click the Download hyperlink in the Document column of the table to download the notice issued to taxpayer.

When a reminder has been issued, Taxpayer can click on Reply to Notice hyperlink appearing against the reminder or Reply hyperlink against the notice under Status column to reply to notice.

Note: Reply button will remain enabled till the due date as extended by the reminders.

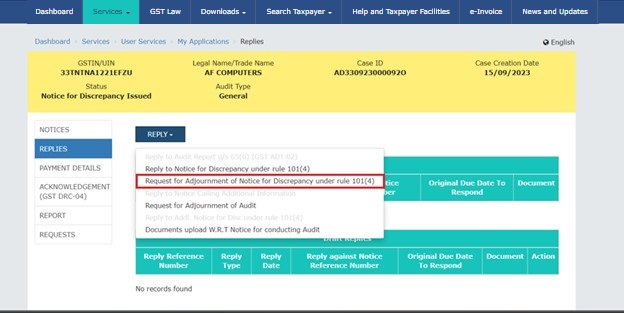

Taxpayer can use this functionality to reply to an issued notice with the supporting documents, additional information, etc. by the due date mentioned in the notice via REPLIES tab. To file your reply to the issued notices, perform the following steps:

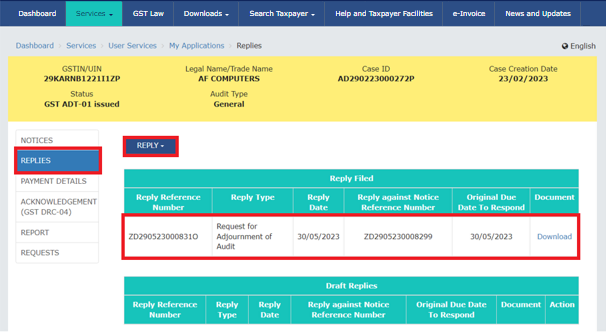

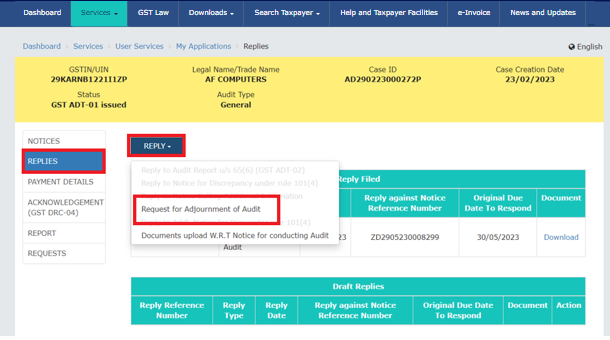

1. On the Case Details page of that particular Case ID, select the REPLIES tab. This tab will display the replies you will file against the notices/reports issued to you.

2. To add a reply, click REPLY and select the Documents upload W.R.T Notice for conducting Audit option from the drop-down.

Note1: You can follow similar steps to Request for Adjournment of Audit, to apply for adjournment of audit case.

Note 2: Documents upload W.R.T Notice for conducting Audit option will be enabled till the due date as extended by the Reminders.

Note 3: Request for Adjournment of Audit option will be disabled once due date to respond as per Notice for conducting Audit ADT-01 has expired.

2a. REPLY page is displayed. Click the Generate Reference Number hyperlink to generate new Reply Reference Number. Other fields will be auto-populated.

2b. Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

2c. Select the declaration check-box to confirm the verification statement.

Note: Click the Preview button to download and review your reply and do any modification/ changes, if required.

2d. Click the Submit button.

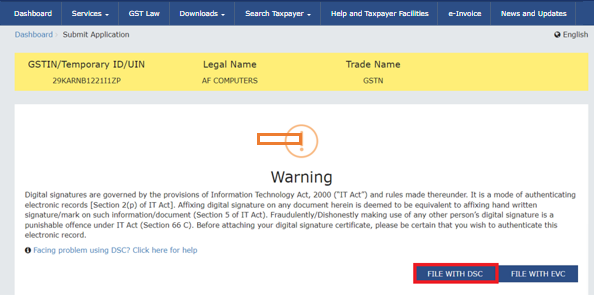

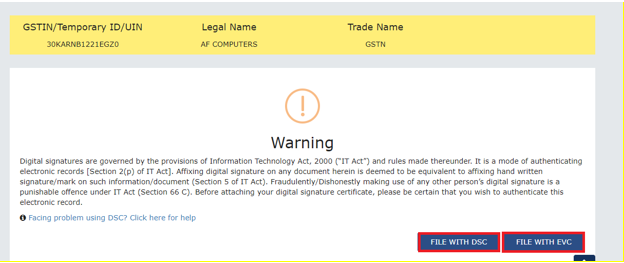

3. A Warning page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

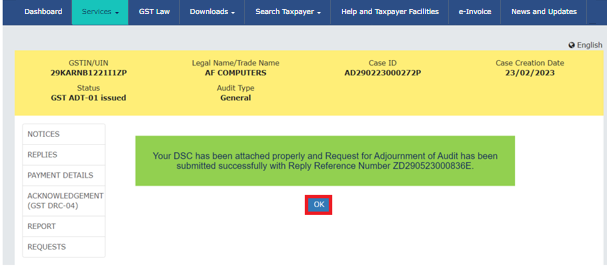

4. A message is displayed confirming your submission. Also, you will receive an acknowledgement intimation via email and SMS.

Note: Once reply is submitted by the taxpayer against the issued notice/report, it will be available to the Tax Official in reply folder of the particular case.

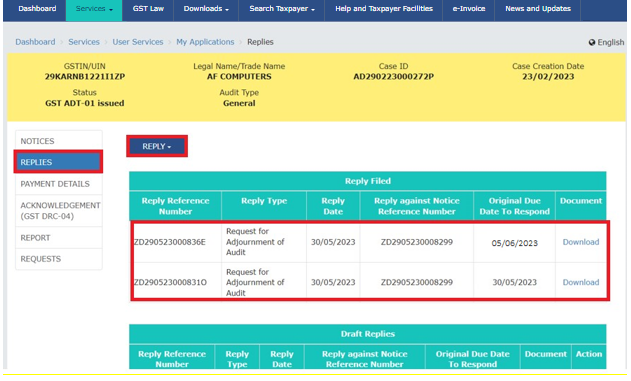

5. In the Reply section, Reply Filed table will be updated. Click the Download hyperlink in the Document column of the table to download the copy of the reply to your system.

.png)

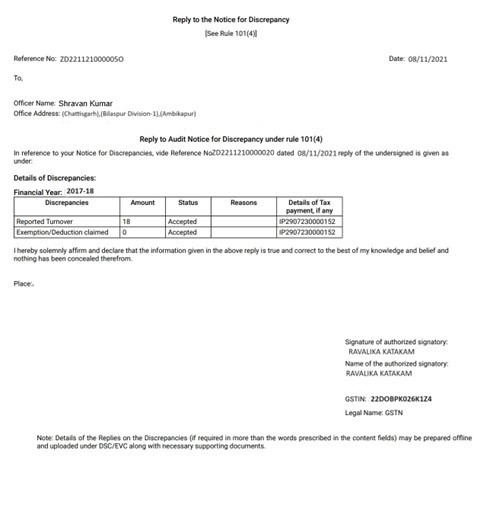

If Audit Officer issues Notice for Discrepancy under rule 101(4), then you can either file a reply to the notice for discrepancy or submit an adjournment request.

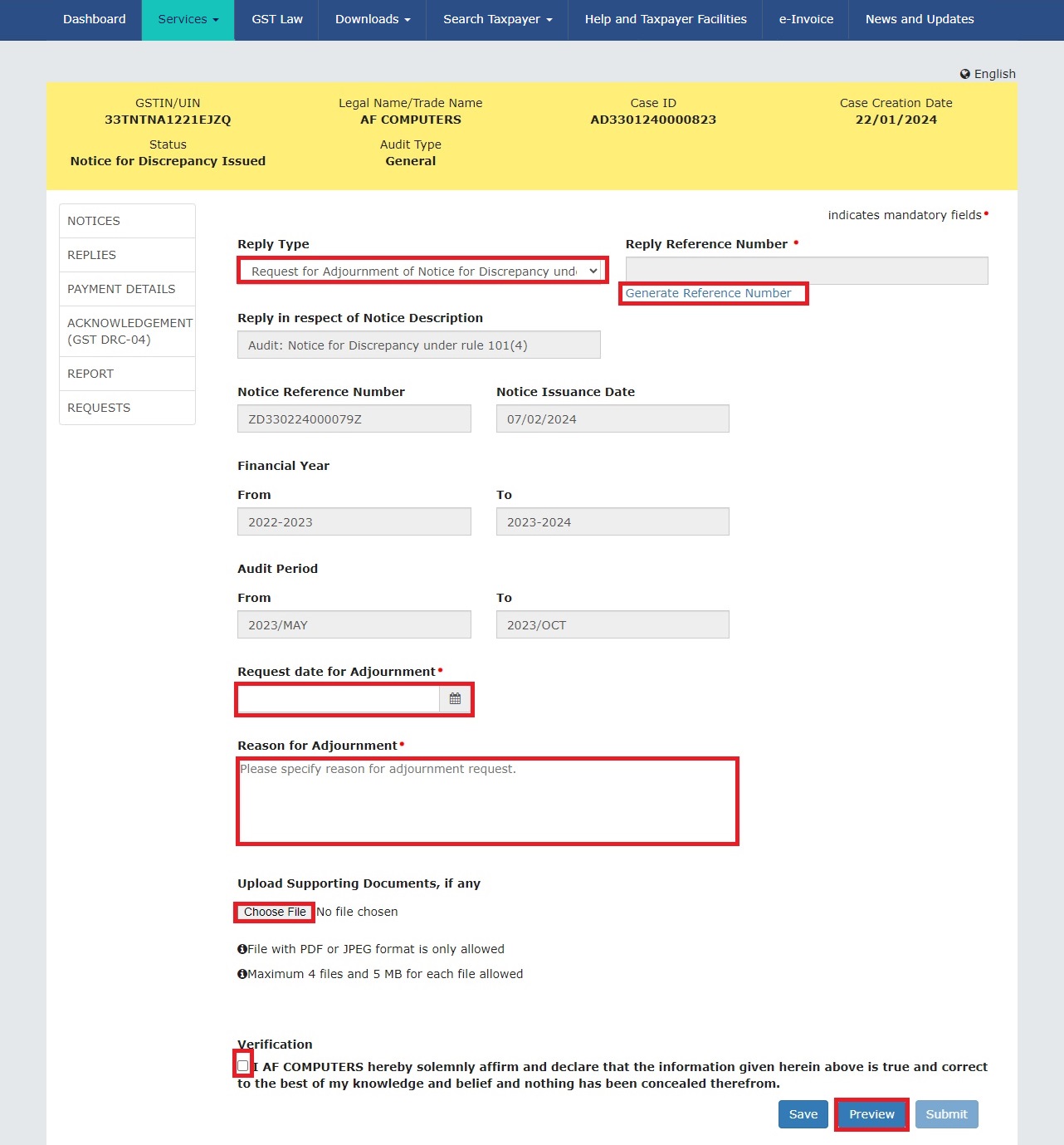

To submit the adjournment request, perform following steps:

1. On the case details page of that particular Case ID, select the NOTICES tab. This tab will display the notices issued to you.

2. To submit adjournment request, click the Reply hyperlink under Status column.

3. Alternatively, taxpayer can navigate to REPLIES tab. From REPLY drop-down list, select Request for Adjournment of Notice for Discrepancy under rule 101(4).

4. REPLIES page is displayed. Click the Generate Reference Number hyperlink to generate Reply Reference Number. Other fields will be auto-populated.

5. Select the Request date for Adjournment from the calendar.

6. Enter the Reason for Adjournment.

7. Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

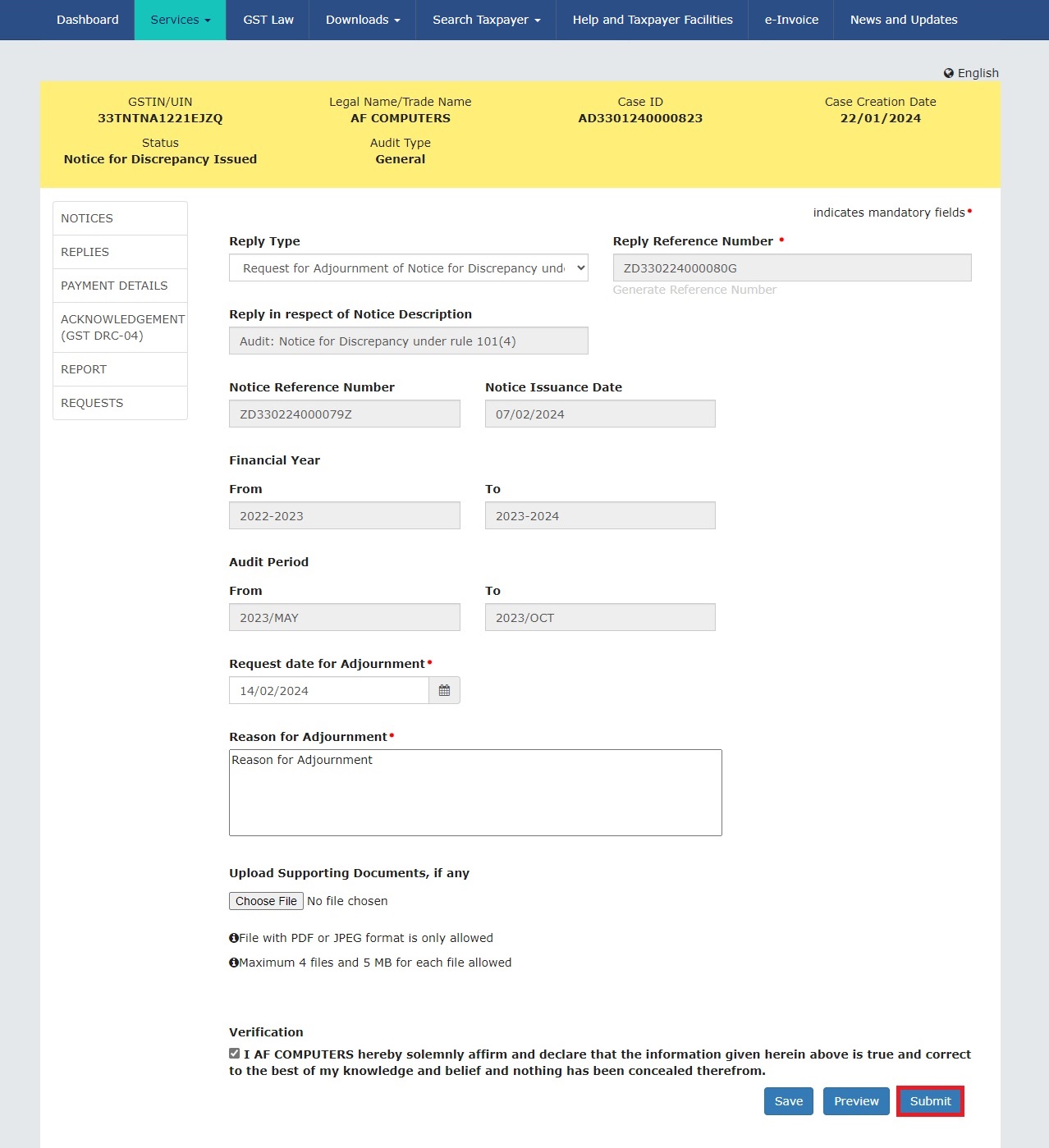

8. Select the declaration check-box to confirm the verification statement.

9. Click the SAVE button.

10. Click the PREVIEW button to download and review your reply and do any modification/changes, if required.

11. Click the SUBMIT button to file the request for adjournment.

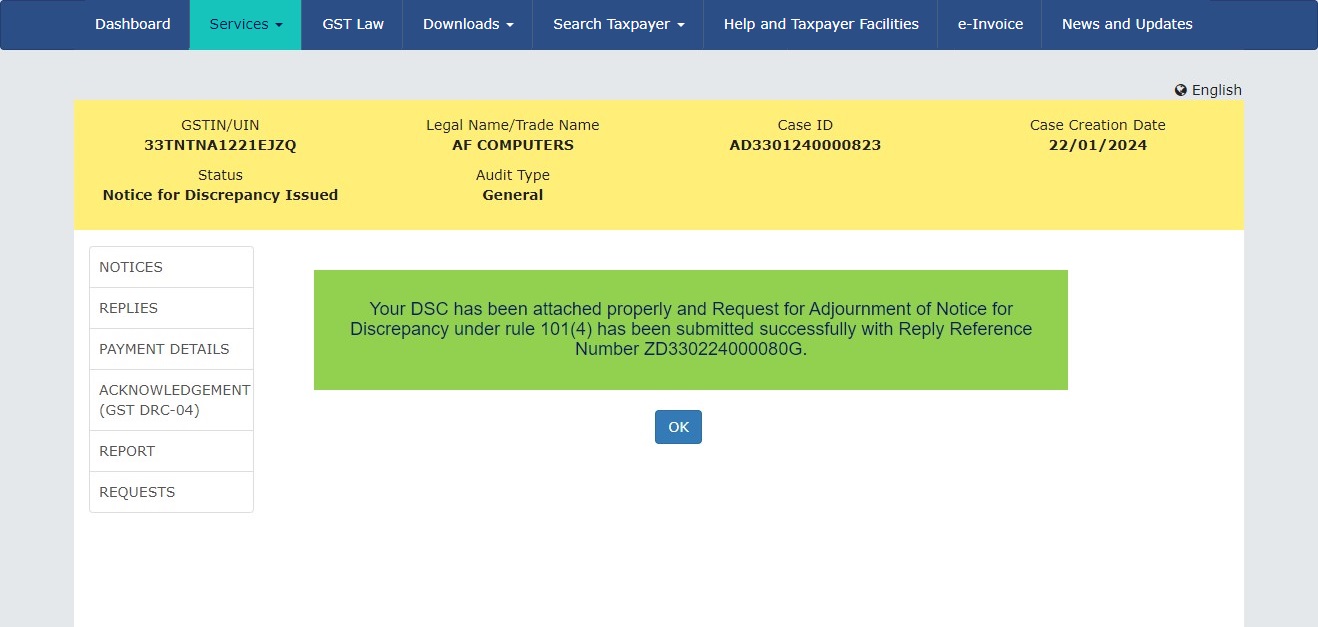

12. Click the FILE WITH DSC or FILE WITH EVC button.

13. Following confirmation message will be displayed on the screen. Click the OK button to proceed.

14. Once reply is submitted by you, it will be updated in the Reply Filed table. The updated details for Request for Adjournment of Notice for Discrepancy under rule 101(4) is displayed on the screen.

Note:

Taxpayer can use this functionality to make payments against the notices/reports issued to them by the Tax Official.

Taxpayer can make payment against following five notices/reports issued to them by tax officer:

1. Notice for Discrepancy under rule 101(4)

2. Additional Notice for Discrepancy under rule 101(4)

3. Audit Report u/s 65(6) (GST ADT-02)

4. Audit Report u/s 66 (GST ADT-04)

5. Show Cause Notice (DRC-01)

To make payments for the notices/reports issued by the Tax Official for a particular case, perform the following steps:

Note: Similar steps will be followed to make payment for Additional Notice for Discrepancy under rule 101(4), Audit Report u/s 65(6) (GST ADT-02) and Audit Report u/s 66 (GST ADT-04).

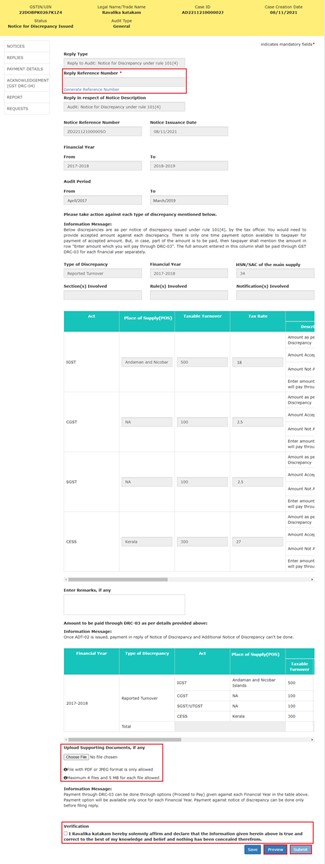

1. On the Case Details page of that particular Case ID, select the REPLIES tab. You can click this tab to file your reply against the notices/reports issued to you.

2. To add a reply, click REPLY and select the Reply to Notice for Discrepancy under rule 101 (4) option from the drop-down.

2a. REPLY page is displayed. Click the Generate Reference Number hyperlink to generate new Reply Reference Number. Other fields will be auto-populated.

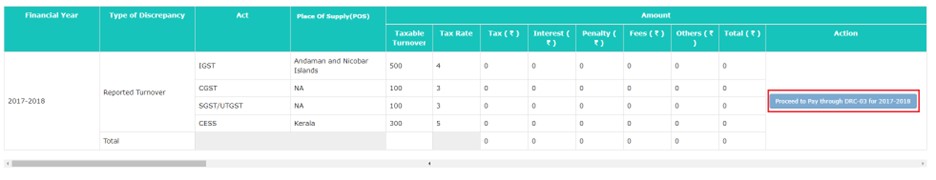

2b. Enter the amount to make payment for against the auto-populated amount under the Amount column.

2c. To make the payment as per above table through GST DRC-03, scroll to right and click on Proceed to Pay through DRC-03 for 2017-2018 button.

2c.1. Intimation of payment made voluntarily against the show cause notice (SCN) or statement or intimation of tax ascertained through Form GST DRC-01A page is displayed.

2c.2. All the details of the form will be auto-populated. You can click on PROCEED TO PAY button to make the payment.

Note:

• Click on “Click here to file DRC-03, if payment is already made” link to file reply in case payment has already been made.

• You can save your payment application and access it later from Dashboard > Services> User Services > My Saved Applications

• For Audit Reports, payment can only be made when the reply is filed.

2c.3. Voluntary Payment Page is displayed. Enter the same values in Cash Ledger Balance table under Pay through Cash column as of Liability table.

2c.4. Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

2c.5. Select the declaration check-box to confirm the Verification Statement. Select the Name of Authorized Signatory from the drop-down and enter Place. Designation and Date will be auto-populated.

Note:

• Click the PREVIEW button to download and review your payment details and do any modification/ changes, if required. Check the system-generated draft reply to rule out any discrepancy.

• In case of shortage of funds in cash ledger, click on CREATE CHALLAN button. To know how to create challan click here.

2c.6. Click the FILE button.

2c.7. A message is displayed confirming the amount being paid towards the liability. Click OK to proceed.

2c.8. A Warning page is displayed. Click the SUBMIT WITH DSC or SUBMIT WITH EVC button.

2c.9. A message is displayed confirming the ARN generation and date. You can download the application by clicking the hyperlink.

Note: You can click on BACK button to go back to reply filling page.

2d. You will be redirected to REPLIES tab on the case details page. Click the Edit button of the draft reply in Draft Replies table to continue filing your reply to the issued notice.

2e. Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

2f. Select the declaration check-box to confirm the verification statement.

Note: Click the Preview button to download and review your reply and do any modification/ changes, if required.

2g. Click the Submit button.

3. A Warning page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

4. A message is displayed confirming your submission. Also, you will receive an acknowledgement via email and SMS.

Note: Once reply is submitted by the taxpayer against the issued notice/report, it will be available to the Tax Official in reply folder of the particular case.

5. In the Reply section, Reply Filed table will be updated. Click the Download hyperlink in the Document column of the table to download the copy of the reply to your system.

6. Payment Details section will be updated with the details of payment made against the issued Notice/Report. You can download the details by clicking on Export in Excel and button.

Taxpayer can use this functionality to view the acknowledgement issued to them by the Tax Official, for the payment made against the issued notices/reports. The acknowledgement is available to view and download in the ACKNOWLEDGMENT (GST DRC-04) tab of Case Details page. To view acknowledgement issued by the Tax Official for a particular case, perform the following steps:

1. On the Case Details page of that particular Case ID, click the ACKNOWLEDGEMENT (GST DRC-04) tab. This tab provides you an option to view the acknowledgement issued to you. Click the Download hyperlink in the Document column of the table to download issued acknowledgement onto your system.

Taxpayer can use this functionality to view the reports issued against them by the Tax Official, in order to get additional information, payments, etc. to proceed further during the Audit process. The reports are available in the REPORT tab of Case Details page. To view reports issued by the Tax Official for a particular case, perform the following steps:

1. On the Case Details page of that particular Case ID, click the REPORT tab. This tab provides taxpayer an option to view the audits report issued to taxpayer. Click the download hyperlink in the Document column of the table to download issued report.

When a Reminder has been issued, Taxpayer can click on Reply to Report hyperlink appearing against the reminder or Reply hyperlink against the audit report under Status column to reply to report.

Note:

• Reply button will be remain enabled till the due date as extended by the reminders.

• Once taxpayer has filed reply against Audit Report (ADT-02) Reply hyperlink against entry Audit Report u/s 65 (GST ADT-02) will be disabled under Status column.

Taxpayer can use this functionality to reply to an issued report with the remarks, payment details etc via REPLIES tab. To file your reply to the issued report, perform the following steps:

1. On the Case Details page of that particular Case ID, select the REPLIES tab. This tab will display the replies you will file against the notices/reports issued to you.

2. To add a reply, click REPLY and select Reply to Audit Report u/s 65(6) (ADT-02) option from the drop-down list.

Note: Once taxpayer has filed reply against Audit Report (ADT-02), Reply to Audit Report u/s 65 (ADT-02) hyperlink will be disabled.

2a. REPLY page is displayed. Click the Generate Reference Number hyperlink to generate new Reply Reference Number. Other fields will be auto-populated.

2b. Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

2c. Select the declaration check-box to confirm the verification statement.

Note: Click the Preview button to download and review your reply and do any modification/ changes, if required.

2d. Click the Submit button.

3. A Warning page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

4. A message is displayed confirming your submission. Also, you will receive an acknowledgement intimation via email and SMS.

Note: Once reply is submitted by the taxpayer against the issued notice/report, it will be available to the Tax Official in reply folder of the particular case.

5. In the Reply section, Reply Filed table will be updated. Click the Download hyperlink in the Document column of the table to download the copy of the reply to your system.

.png)

If Audit Officer rejects first adjournment request, then you can submit second request for adjournment, perform following steps for the same:

1) On the case details page of that particular Case ID, select the NOTICES tab. This tab will display the notices issued to you.

2) To submit second adjournment request, click the Reply hyperlink under Status column.

3. You will be navigated to REPLIES tab.

4) From REPLY drop-down list, select Request for Adjournment of Audit.

5) REPLIES page is displayed. Click the Generate Reference Number hyperlink to generate Reply Reference Number. Other fields will be auto-populated.

6) Select the Request date for Adjournment from the calendar.

7) Enter the Reason for Adjournment.

8) Click the Choose File button to upload the supporting documents, if any.

Note: You can upload four PDF/JPEG files with maximum size of 5 MB each.

9) Select the declaration check-box to confirm the verification statement.

10) Click the SAVE button.

11) Click the PREVIEW button to download and review your reply and do any modification/changes, if required.

12) Click the SUBMIT button to send the second request for adjournment.

13) Click the FILE WITH DSC or FILE WITH EVC button.

14) Following confirmation message will be displayed on the screen. Click the OK button to proceed.

15) Once reply is submitted by you, it will be updated in the Reply Filed table. The updated details for Request for Adjournment of Audit is displayed on the screen.

Note:

• If your request for adjournment is rejected by the officer, you can make a second request for adjournment.

• You cannot request for adjournment if your adjournment request is accepted by tax officer.

• You cannot request for the third adjournment of audit if the second adjournment request is rejected by the Audit Officer.

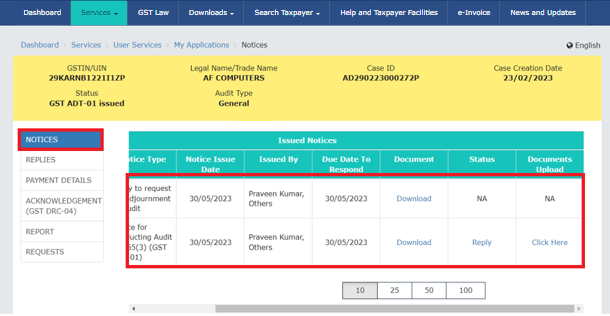

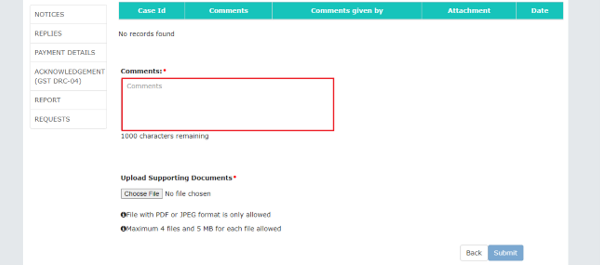

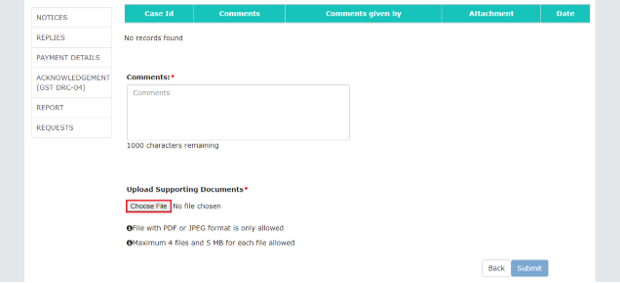

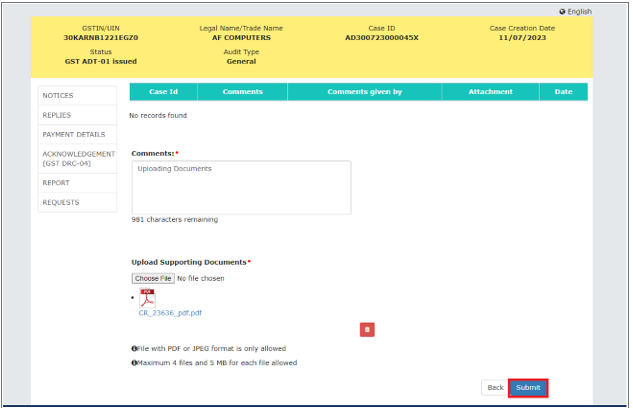

Taxpayer can use this functionality to upload document in respect of an issued notice via NOTICES tab. To upload document to the issued notices, perform the following steps:

1. On the Case Details page of that particular Case ID, select the NOTICES tab. This tab will display the notices issued to you.

2. Under Documents Upload column, click on the Click Here link.

Note: The Click Here link will only be enabled post reply of Notice for conducting Audit u/s 65(3) (GST ADT-01) through Reply link under Status column.

3. On the Document Upload page, enter the comments in the Comments box.

4. Click the Choose File button to Upload Supporting Documents.

Note: Only PDF or JPEG files can be uploaded. You can upload up to 4 files of 5MB each.

5. Click the Submit button to submit the documents.

6. Click the FILE WITH DSC or FILE WITH EVC button to proceed.

7. Following message will be displayed on screen after successful submission. Click the OK button.